- Site InsuranceSite Insurance

Self Build Site Insurance is necessary to protect your investment when you’re carrying out a renovation, conversion, extension or new build. Our self build site insurance policies cover the new work, existing structure and rest of the site.

- Conversion InsuranceConversion Insurance

Protect your project with quality building conversion insurance with Self-Build Zone. Conversion projects come with risk, so make sure you have cover in place.

- Extension InsuranceExtension Insurance

Enjoy your home transformation with peace of mind from day one. Self-Build Zone offers comprehensive extension insurance for your next project.

- New Build InsuranceNew Build Insurance

Self-Build Zone offers a range of new build insurance policies for developers or self-builders. Protect all aspects of your project with us today.

- Renovation InsuranceRenovation Insurance

A renovation is an exciting project to transform your home. Renovation insurance from Self-Build Zone protects your project from start to finish.

- Policy OverviewPolicy Overview

Self-Build Zone knows Site Insurance is of fundamental importance when investing your money into property development, especially as the sums are almost always five or six figures.

Whether your project is a Conversion, Renovation, Extension or a New Build, you will invariably need comprehensive protection for the new works, the existing structure (if there is one) and the rest of the site.

- Developer InsuranceDeveloper Insurance

Developer Insurance can provide cover for small to medium new-build developments with a professional reinstatement cost up to £1.5 million and larger projects on referral, as well as being suitable for renovation, conversion and extension projects on existing properties.

- Conversion InsuranceConversion Insurance

- Structural WarrantyStructural Warranty

Our award-winning 10-year structural warranty insurance protects against defects in design, materials or workmanship of your home for a decade after completion.

- Get a QuoteGet a Quote

- ResourcesResources

Get all the latest resources you need for your self-build project.

- A Rated InsurersA Rated Insurers

When you build a self-build or new home, it’s crucial you ensure it has a 10 year Structural Warranty in place so you can sell it easily and protect your project. But with a range of Self-Build structural warranty providers, how do you know who to choose? It’s simple – always go for an ‘A’ Rated provider, or you risk choosing an unstable company that could leave you uninsured.

- Approved LendersApproved Lenders

Build-Zone is widely accepted by lenders in the UK, as structural and home warranty providers.

- ArticlesArticles

Below are some articles that our experts have written. From plan checks to plumbing and everything in between heres how to protect your project from start to finish.

- ContractStoreContractStore

Developed in collaboration with Self Build Zone, who provide insurance products for the self-build market, these legal contracts are created to protect your interests.

- ExhibitionsExhibitions

Self-Build Zone exhibit at many of the major self-build exhibitions and renovation events, including the HomeBuilding shows at Harrogate, Farnborough, Bath and South West and Birmingham, as well as Build It Live at Maidstone and Bicester.

- Health & SafetyHealth & Safety

If you are planning on carrying out renovation work to your home, you need to consider specialist insurance for this, such as renovation insurance. A home renovation project is an exciting time. Renovating your home improves its look and often adds value, however, it doesn’t come without its risks. You need to protect your materials, any damages that could be incurred during the renovation or even injury.

- FAQFAQ

Site Insurance & Structural Warranty FAQs – Get the answers to your burning questions on Self-Build Zone’s Frequently Asked Questions. You’ll find information on our insurance policies, services and lenders.

- SecuritySecurity

Self-Build Zone has chosen some key pointers about building site security that will help you reduce the chances of your site being targeted.

- Recommended BusinessRecommended Business

Self-Build Zone has worked with a number of companies over the years. See a few suppliers and associations we work with closely.

- Survey ServicesSurvey Services

- TestimonialsTestimonials

If you’re considering Self-Build Zone for expert site insurance or structural warranties, see what our customers say about us in our latest testimonials.

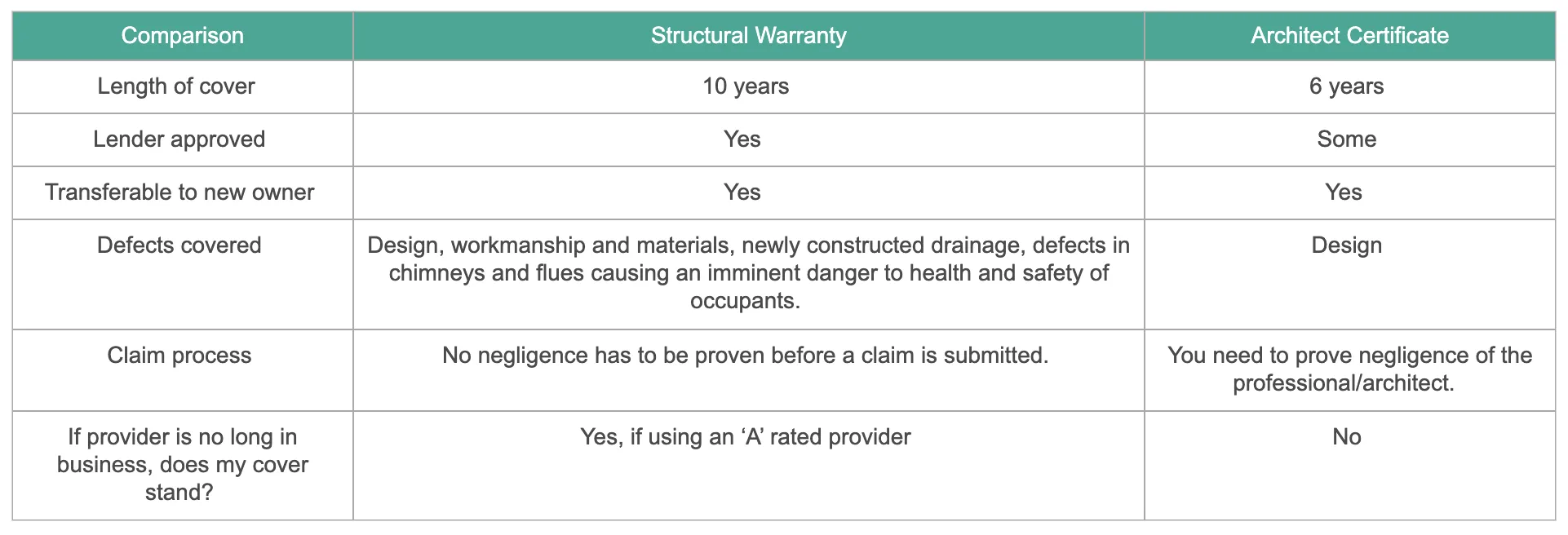

- What are Architect Certificates?What are Architect Certificates?

Ensure your build is covered correctly by knowing the differences between architect certificates and structural warranties.

- A Rated InsurersA Rated Insurers

- News and ViewsNews and Views

Latest news

- Contact UsContact Us

Contact Us page

- Sign InSign In